tax strategies for high income earners book

The Setting Every Community Up for Retirement Enhancement SECURE Act which was part of the December 2019 tax package includes several provisions that affect the high income earners retirement planning and tax planning strategies. And things are about to get worse if President Biden gets his way.

The Hierarchy Of Tax Preferenced Savings Vehicles

If you are 50 or older you are eligible to contribute another 6500 as a catch-up contribution.

. The biggest and best way weve seen highly paid high functioning people reduce their tax is through changing the way they get paid. Typically high-income earners cannot open or contribute to a Roth IRA because theres an income restriction. The SECURE Act.

Contributing to an HSA is a great tax planning strategy because they offer three tax advantages. Ad Tax-Smart Investing Can Help You Keep More of What You Earn. Withdrawals are tax free for qualified expenses.

Schedule a call with Bay Point Wealth to find out how we can help. The growth is tax free. When your income exceeds a certain limit you are subject to high taxes which can go up to rates of 50 of your total income.

A Solo 401k can be the single most valuable strategy among all the tax saving strategies for high income earners. Tax planning strategies for high income earners please contact us for more information Canadians who earn more than 200000 per year. Contribute to your superannuation fund.

For 2021 the IRS Solo 401k contribution limit is 58000 before eligibility for catch-up contributions. You may also like. The contributions are tax deductible.

The age for Required Minimum Distributions RMDs from retirement accounts was raised to 72. If you have a high-deductible insurance plan you can put some of your money in Health Savings Accounts for retirement and medical purposes. Often this can cause a great dent in your finances especially if most of your wealth is tied up in non-liquid assets.

Effective tax strategies for high-income earners should include managing the timing of large gains so you arent subject to the Medicare surtax or pushed into the 20 capital gains bracket. New tax legislation made small reductions to income tax rates for many individual tax brackets. Tax strategies for wealthy.

That is why many financial advisors specialize. Contact a Fidelity Advisor. If youre one of those high income earners the proposed increase will see your tax bracket rise to as much as.

In 2021 the employee pre-tax contribution limit for 401 k and 403 b plans is 19500. Tax strategies for high income earners. Tax planning for high income canadians.

Ive only Call us now. If you are a high earner with an income above the IRSs income limit for Roth IRA accounts you still have the option to create a backdoor Roth IRA. If you are a taxpayer living in England or Wales you will pay 40 income tax for an income of over 50270 assuming a full personal allowance is available.

One person found this helpful. Change the way you get paid. You may give up to 16000 32000 if you are married to as many individuals as you wish without paying federal gift tax so long as your total gifts keep you within the lifetime estate and gift tax exemption of 1206 million for 2022.

A couple of weeks ago one of my clients asked me to read Dave Ramseys book The Total Money Makeover. Most common is to start a business consulting to other similar businesses who need their skill knowledge or service. For those of you looking to invest 5 million you can request your own copy of our book 7 Secrets to High Net Worth Investment Management Estate Tax and Financial Planning For Families With Liquid Investable Portfolios Between 5 Million and 500 Million to learn more about tax planning.

Potential contributions for HSAs are capped at 3600 for individuals and 7200 for families but you can contribute an additional 1000. Just as it sounds this option allows high earners to bypass the income limits and still utilize the tax advantages of a Roth IRA account. Tax Strategies for High-Income Earners Consider using above-the-line deductions to help reduce your adjustable gross income AGI.

The annual gift tax exclusion gives you a way to remove assets from your taxable estate. Knowing the right tax reduction strategies for high-income earners is key to lowering your income taxes. Scottish taxpayers will continue to be subject to income tax at 5 different rates ranging from 19 Starter Rate to 46 Top Rate for any income in excess of.

STRATEGIES FOR FAMILIES WORTH 5 MILLION TO. If you are a taxpayer living in England or Wales you will pay 40 income tax for an income of over 50270 assuming a full personal allowance is available. The current top marginal tax rate in the US is 37.

In this example the minimum repayment amount will be 1667 each year for 15 years until the balance of 25000 is fully repaid. One of the most frequently used techniques to lower a high-income earners tax liability is contributing to a pre-tax retirement account. The issue of Canadian Tax loopholes has put a target on privately held domestic corporations in Canada and their uses of business tax rates and personal income tax rates.

This money is put in the account before taxes lowering your taxable. 1 Managing through. Tax laws change often and increasing complexity makes it hard to stay on top of the latest tax saving strategies for high income earners.

I definitely recommend this book to high income individuals looking to shelter their income from high tax rates. RRSPs allow you to shelter up to 18 of your gross income per year this maxes out for high income earners who make above 145000 per year The one drawback of the RRSP tax. Thats especially true if you earn more than 400000 as an individual or 500000 as a couple.

A backdoor Roth IRA is a convenient loophole that allows you to enjoy the tax advantages that a Roth IRA has to offer. To create a backdoor Roth IRA youll need to. You are allowed to put in 3600 per individual per year and 7200 for families in 2021 and 3650 and 7300 for families in 2022.

Ad Browse Discover Thousands of Business Investing Book Titles for Less. Tax Strategies for High Net-Worth Individuals. A Solo 401k for your business delivers major opportunities for huge tax deductions every year.

For instance the 2017 Tax Cuts and Jobs Act was the largest overhaul of the tax code in a generation. Here are five investment options for high-income earners. Tax Strategies for High Income Earners PillarWM.

Find out how to lower your tax bill for 2020.

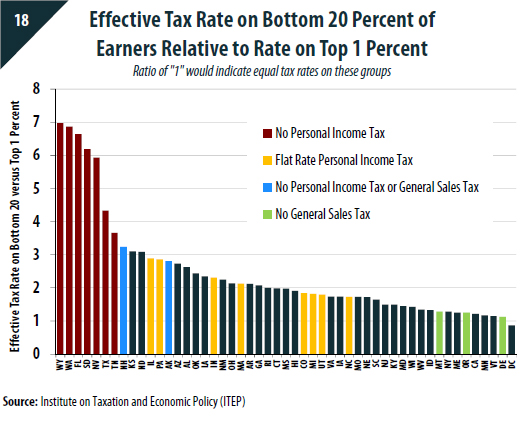

How Do Taxes Affect Income Inequality Tax Policy Center

Amazon Com Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes Audible Audio Edition Adil N Mackwani Will Stauf M A Wealth Audible Books Originals

How Do Taxes Affect Income Inequality Tax Policy Center

Fairness Matters A Chart Book On Who Pays State And Local Taxes Itep

Ppc S Guide To Tax Planning For High Income Individuals Corporations Tax Thomson Reuters

How To Do Backdoor Roth Ira Roth Ira Roth Ira Contributions Finance

Amazon Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes Mackwani Adil 9781734792621 Books

Episode 67 Investing For High Income Earners Wealthability

Ceci Marshall Finance Mentor On Instagram Follow Financesreimagined For More Finances And Wealth Building Tips As I P Roth Ira Finance Wealth Building

How Does A Backdoor Roth Ira Work Roth Ira Finance Saving Ira

5 Outstanding Tax Strategies For High Income Earners

Liberals To Go Further Targeting High Income Earners With Budget S New Minimum Income Tax R Canada

Amazon Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes Mackwani Adil 9781734792621 Books

Asset Protection For Business Owners And High Income Earners How To Protect What You Own From Lawsuits And Creditors Ebook By Alan Northcott Rakuten Kobo Higher Income Asset Business Owner

High Income Earners Can Use This Tax Friendly Strategy To Save For Retirement Cnbc Tax Return Higher Income Saving For Retirement

The 4 Tax Strategies For High Income Earners You Should Bookmark

What Is Wrong With The American Tax System For The Middle Class Finance Organization Finance Planner System